Capital Funding

Our goal is to match the needs of the business to the best available source of funding & strategy. We do this by taking a holistic approach – Looking at all options (public and private financing programs) for our clients. Incentive Capital looks at what kinds of deals are closed with each funding type and source. We conduct a financial review and look at the business strategy to help determine the best source of funding. These include:

- Venture/Private Equity and other traditional sources

- New Market Tax Credit (state & federal) – The first step is to prepare a comprehensive financial package that is distributed to lenders, investors, and CDEs that match the nature and goals of the project. Our team has developed strong personal and professional networks with the majority of the NMTC industry…they take our calls!

- Other State Tax Credits – State credits vary greatly from state to state. These could include new employee training programs and salary rebates, property tax incentives for new development, etc. Research is conducted within the current or proposed state of the operating business to determine eligibility.

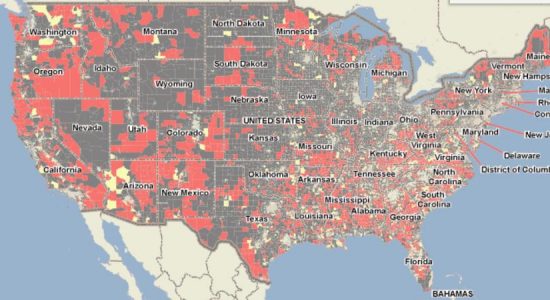

- Opportunity Fund – This is a new non-traditional form of securing capital investment for businesses, which uses the reinvestment of capital to support businesses in eligible opportunity zones.

- Other forms of financing including those from banks, private loans, etc.

Call now

for free consultation

for free consultation

: (720) 624-1868

Mail now

free consultation

free consultation

: info@incentivecapitalfund.com

CONSULTING SERVICE

Providing a wide range of consulting services, resulting in happy customers